- +1 (844) 334-1456

- [email protected]

- Mon - Sun 24 Hours

We've Streamlined The Process & Made It Easy So That You Don't Have To Do Probate Alone!

Probate Services in Glen Rock Virginia

MAKE PROBATE EASY WITH PROBATE BUTLER! Whether you are the Executor Of the Estate, Personal Representative, or a Probate Attorney, let our trained Probate Butlers Help You.

Rest easy knowing that our team of experts are working on your behalf to deliver results based on your schedule and timeline! Proudly serving Chesapeake, Norfolk, Virginia Beach, Hampton, Newport News, Arlington, Williamsburg, Hopewell, Colonial Heights all surrounding areas.

We Never Charge You Or Your Estate, So Make Probate Easy With Your Probate Butler Today!

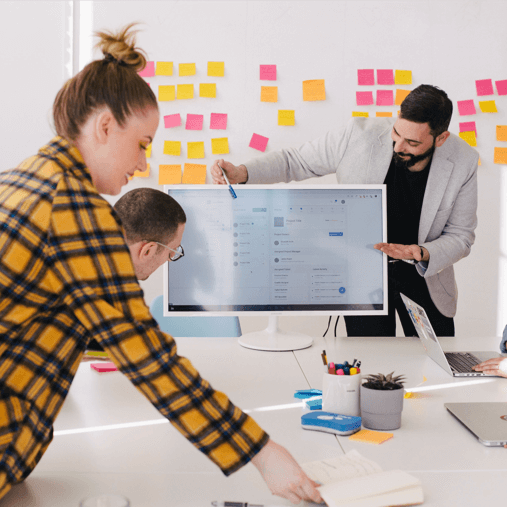

There isn’t a handbook on what to do when you become an executor of an estate. This can become quickly overwhelming for anyone. We’ve designed Probate Butler to be your personal assistant and help you through this sometimes burdensome process by putting vetted experts in your area in one location for easy access and scheduling. Weve done all the vetting for you in order to streamline this process while you focus on you and your family during this difficult time.

Ask Any Questions You Want

Our professionals are here to answer any and all questions that you may have 24 hours a day.

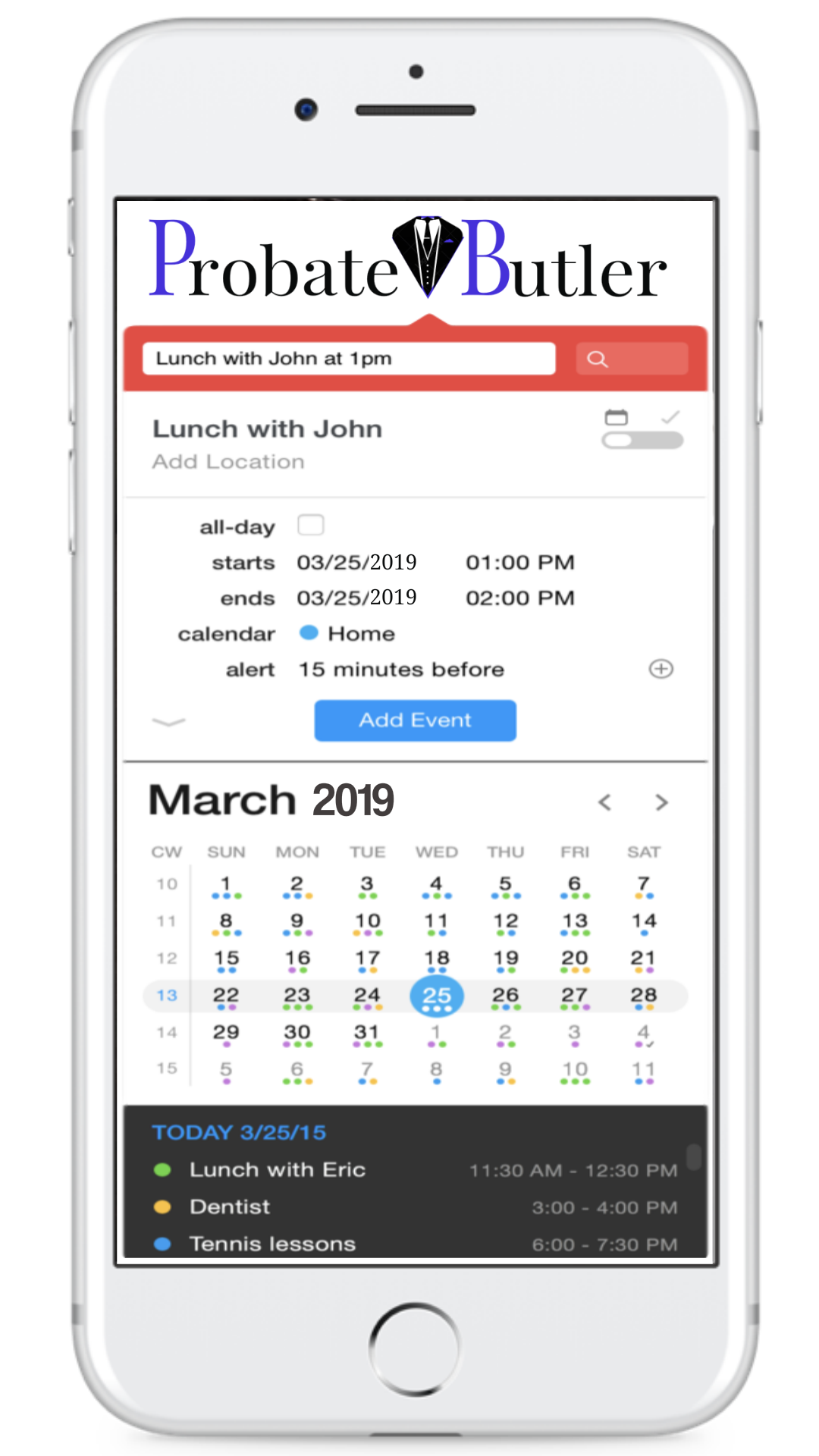

Easy To Use & Communicate

Have a cell phone? Than you already have everything you need at your fingertips.

Scheduling & Calendar

All scheduling of appointments are done through the app so no matter which service pro you need, you have 100% access to them.

Ease Of Use & FREE

We created Probate Butler with you in mind so it is easy to use and will never cost you or your estate a dime, so it is FREE for you!

Save Time & Frustration

With all of our vetted local professionals in one place, you save time. money, and headaches.

Vetted Local Experts

All of out partner vendors are vetted and have a 4.9 or 5 star Google rating in your area.

Don't Take On Probate By Yourself, Download The FREE App Today So That Our Team Of Experts Can Make This Fast, Easy, & Hassle Free As Possible!

The process of selling your loved one’s home is likely going to be emotionally challenging.

From the sorting of the personal belongings to the finalization of the sale at the closing table. By surrounding yourself with professionals who are empathetic and helpful, this process can be easier than ever before. We’ve streamlined the probate process to help you transition through this as easily and smoothly as possible.

By bringing together all of the service professionals you may need during these trying times, we are better able to help serve you and your needs 100% FREE of cost to you or your estate!

What Is Probate Butler & Can It Really Be FREE?

We Handle Your Probate Needs From Clean Out To Closing & Help Coordinate Everything For You

Unfortunately, many estate properties suffer from deferred maintenance, either because the late homeowner was ill or simply could not maintain it properly for other reasons. You can alleviate the anxiety of repairing and/or maintaining the probate property by leaving the details to my team of carefully vetted reliable home professionals to bring the home up to a marketable condition in order to be sold in a competitive market.

Probate Attorney

A probate lawyer is a state-licensed attorney who advises personal representatives, also called executors, and the beneficiaries of an estate on how to settle the final affairs of a deceased person.

Surviving Spouse Liason

Most people will experience loss at some point in their lives. Grief is a reaction to any form of loss. Bereavement is a type of grief involving the death of a loved one. The process of adapting to a significant loss can vary...

Estate Sales Company

An Estate Sale, also called a Tag Sale in some parts of the country, is a way of liquidating the belongings of a family or estate. These are usually much more than garage or yard sales. They are used when someone is...

Financial Advisor

A financial adviser (or advisor) is a professional who provides financial guidance to clients based on their needs and goals. Typically, they provide clients with financial products, services, planning or advice related to investing, retirement, insurance, mortgages, college savings, estate planning, taxes and more.

Realtor

A real estate agent is an industry professional who serves as the facilitator of real estate transactions. They are ultimately responsible to bring buyers and sellers together and are paid a commission—a percentage of the sale price.

Family Law Attorney

From making decisions about assets, alimony or child support, a family law attorney can be very beneficial to help ensure that these proceedings go according to plan and needs. A family lawyer can make sure your rights are protected and you get everything you are entitled to.

Wealth Management

Wealth management combines both financial planning and specialized financial services, including personal retail banking services, estate planning, legal and tax advice, and investment management services. The goal of wealth management is to sustain and grow long-term wealth.

Handyman Services

A handyman, is a person skilled at a wide range of repairs, typically around the home. These tasks include trade skills, repair work, maintenance work, are both interior and exterior, and are sometimes described as "side work", "odd jobs" or "fix-up tasks".

Clean Up Crew

Selling, moving out of, or simply decluttering a whole house can be a messy process. Whole house clean out services cover the removal of furniture, clothing that has been left behind, taking out kitchen appliances and dinnerware, a basement clean out and/or attic, plus a garage if needed.

Let Us Help You Get Everything You Didn't Know You Needed!

Planning

We can help with all of the planning needed to complete the probate process efficiently, effectively, and without headaches.

count on us

Collaboration

Collaborating with everyone you are going to need while transitioning through the probate process is now easier than ever before when you let Probate Butler take the wheel and schedule the professionals you need when you need them.

try, try again

Execution

Now you can handle all of the responsibilities as the “Executor of the Estate” without having to make this a burdensome task with a bunch of “Unknowns”! We’ve simplified the process and have streamlined the procedures to make this as stress free as possible.

Timothy Powell

Partnership Liason Manager

Lisa R. Boone

Transaction Coordinator

we love them

what our clients have to say

“What an amazing experience! I really couldn't believe how easy and convenient the service was. My husband couldn't believe it was actually free!"

Sophie LeonardFredericksburg, Virginia

“What an amazing experience! I really couldn't believe how easy and convenient the service was. My wife couldn't believe it was actually free!"

Herman NortonRichmond, Virgnia

“What an amazing experience! I really couldn't believe how easy and convenient the service was. My husband couldn't believe it was actually free!"

Amanda ParksVirginia Beach, Virginia

We strive to make our clients happy

We happily service Glen Rock Virginia and all surounding area including Greenwich, Newtown, Lansdale, Huntington, Woodhaven, College Park, Larkspur

Ask Us Anything

We Have Great Answers

Probate

When a person dies, their last will and testament (assuming they prepared on in advance) is handled and their wishes for the distribution of their personal property implemented through a process called probate. Probate simply means the procedure by which their last written directives are legally certified as the final statement of their wishes regarding their worldly possessions (including any property or properties they may have owned). It also confirms the appointment of a person or entity the deceased person selected to administer their estate. The term probate is also frequently used to refer to the entire process of “probating” an estate. In this usage, it refers to the entire process that gathers all available assets, pays any outstanding debts, taxes, administrative expenses and then finally makes the specified distribution of remaining assets to those persons or entities designated by the will.

The personal representative (also known as the executor or executrix) who is named in the will is legally in charge of this process and is responsible for handling the orderly method for administration of the estate as set forth by the probate laws and procedures of their state. The executor is typically held accountable for their actions and decisions by the heirs and other beneficiaries and in some cases may be formally supervised by a probate court. If a will does not exist or a personal representative is not designated in the will, the court will appoint one (assuming there is personal property to distribute).

The personal representative is often entitled by law to a reasonable fee or commission for their services.

Probate law generally encourages or provides for partial distributions of funds during the period of administration and assets are often distributed “in kind” rather than sold during this period. Tax laws generally look to the personal representative as being responsible for making death tax filings and other tax payments from the outstanding assets of the deceased. Therefore, choosing an executor/executrix/personal representative is an important decision.

The basic job of administration and accounting for assets must be done whether the estate is handled by a personal representative as part of the probate process or if probate is avoided. In the recent past, lawyers and other professionals have advocated the use of probate avoidance techniques (such as revocable trusts, etc.) in states where the probate process has been seen to be too slow and overly expensive. In recent years, many states have simplified or streamlined their probate processes and, in such states, there is now less reason to employ probate avoidance techniques.

The duration of the probate process is subject to lots of different variables, but a general rule of thumb is approximately six months. However, you should be aware that it can and frequently does takes far longer. Some of the matters that can delay the completion of the process (among others) can include:

If there is a will, the Personal Representative (sometimes referred to as the “executor” or “executrix”) is usually responsible. If there is no will, an “administrator” is appointed by the court as part of the probate proceeding and that person has the responsibility for managing the estate through the proceeding, subject to established probate rules and procedures.

In many states, the probate court has a considerable amount of control over the activities of the Personal Representative and requires that she or he obtain prior permission of the court before certain actions, such as the sale of real estate or business interests owned by the estate, may take place.

Of course not. It is always your option to serve or decline. Even if you agree to serve you can resign later. If you do quit before the completion of probate, you may be required to provide an “accounting” for the period you served. If you decline to serve (or accept and resign later) any alternate named in the will is typically appointed by the court. If no alternate representative is named in the will or the named alternate dies or is unwilling to serve (or, of course, if a person dies without a will, the probate court will appoint someone to serve as the personal representative.

The main tasks of a Personal Representative are to:

(1) determine if there are any probate assets;

(2) identify, gather, and inventory the assets of the deceased;

(3) receive payments due the estate, including interest, dividends, and other income (e.g., unpaid salary, vacation pay, and other company benefits);

(4) set up a checking account for the estate;

(5) figure out who is going to get what and how much under the Will (if there is no Will, the state’s “interstate succession laws” apply);

(6) value or appraise the estate’s assets;

(7) give legal notice to potential creditors (the procedure and deadlines for creditors to file claims vary from state-to-state);

(8) investigate the validity of all claims against the estate;

(9) pay funeral bills, outstanding debts, and valid claims;

(10) pay the expenses of administrating the estate;

(11) handle various paperwork, such as discontinuing utilities and charge cards, and notifying Social Security, Civil Service, and Veterans Administration of the death;

(12) file and pay income and estate taxes;

(13) distribute the remaining property in accordance with the instructions provided in the deceased’s Will; and

While there is usually no legal requirement to use a probate lawyer, probate is a rather formalistic procedure. One minor omission, one failure to send Great Aunt Maggie a copy of the petition, or a missed deadline, can cause everything to come to a grinding halt or expose everyone to liability.

The death of a family member or friend sometimes tends to bring out the very worst in some people. Experience shows that even in close families there is a tendency to get overly emotional about relatively trivial matters at the time of a loved one’s death, such as who gets the iron frying pan and who gets the kettle. Such minor matters or any delays or inconveniences can be upsetting, pose issues of fairness, and create unfounded suspicion among family members. Thus, it generally is a very good idea to “let a lawyer do it”.

It is not a requirement, but usually they are compensated. Certainly, all personal expenses they incur in the management and process of settling the estate must be paid for. Typically, a personal representative earns a fee of +/- 2% of the total value of the estate for their work. This can be mandated by the courts or by law in some states and varies moderately from state to state. Generally, this percentage diminishes as a percentage as the size of the estate increases.

All funds paid to the personal representative are subject to approval by the probate court. Additional fees may be allowed by the court in cases of unusual difficulty or extraordinary circumstances. On the other hand, if a personal representative does not perform their duties in an orderly or timely manner, the court may reduce or deny compensation and the Personal Representative may be held responsible for any damages caused.

If a person is both the sole beneficiary of the estate, and the estate is not subject to Federal Estate Tax, it usually does not make sense to take any fees as all fee income is subject to income tax. (The money a beneficiary receives from the estate is income tax-free.)

An executor or administrator who is derelict in his or her duty is personally liable for damages caused in the administration of the estate.

Liability may arise from improperly managing the assets of the estate, failing to collect claims and sums of money due to the estate, overpaying claimants, selling an asset without the authority to do so, or at an inappropriate price, neglecting to file tax returns on time, distributing property to the wrong beneficiaries, etc.

This means that the Personal Representative might wind up paying for the loss out of his or her own pocket.

Don't Do Probate Alone, We Are Here To Help

Probate Butler does everything you could possibly want it to do to help you through the probate process and its truly 100% FREE so get started today.

Can We Help You Today?

Our Team Of Local Professionals Are Here For You, Simply Begin By Typing In The Chat.